I opened an email earlier this evening that literally felt like I was punched in the stomach. It was my Nelnet loan statement. It is a combo of my undergrad and current grad school loans. Let’s just say even if I didn’t want to work after I finish school, I’m going to have to, in order to pay the tens of thousands of dollars I now owe. In the end my education is worth every penny, but my hope is that my children do not have to be in this same predicament. Between my husband and I, we owe a whole heck of a LOT of money. I am going to work hard and save to make sure both of my kiddos do not have to be in the situation of having to pay an exorbitant amount for college.

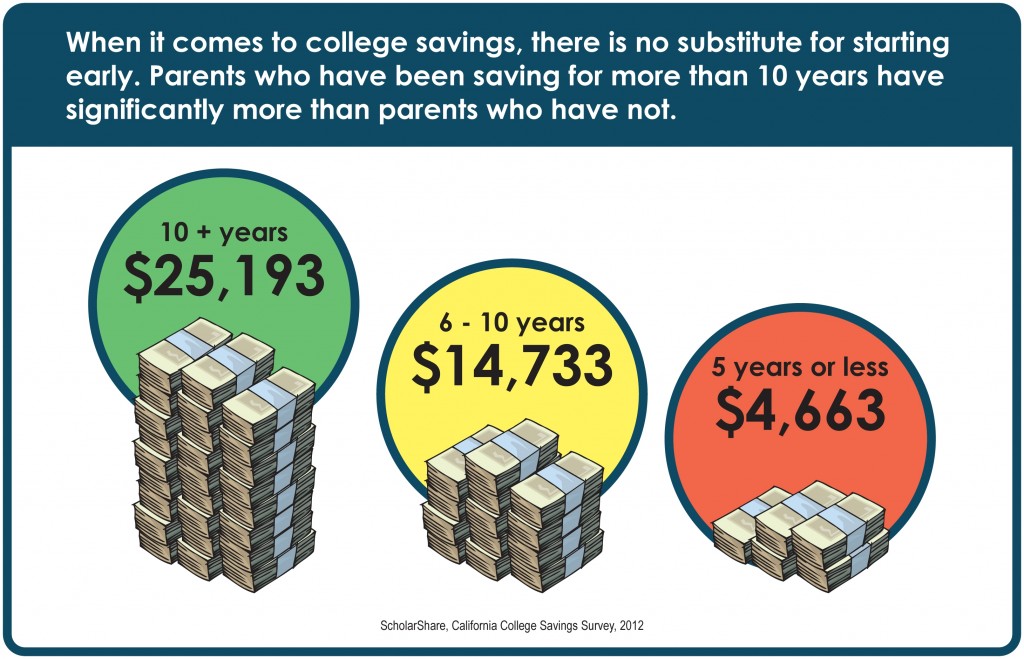

One way to make sure my goal of a full funded college education for each of my children is to make sure to start saving early. Did you know that more than three-quarters (78%) of California parents say that getting a higher education is more important today than it was 10 years ago. Parents of color are especially likely to highlight the importance of college, with 87% of Latino and African-American parents, and 84% of Asian parents indicating that higher education has become more important over the past decade.

However, expectations on how children will attend college differs between ethnicities. Half of Latino and African-American parents, versus 36% of white parents and 43% of Asian parents expect scholarships to cover a majority of their college costs. This means a majority of families aren’t planning for the future. It’s a scary statistic, especially for Latinos, which are the least inclined to save.

It’s especially frightening since between 1985-2005, tuition has risen 439 percent. I know that in my last two years of my degree, tuition almost doubled at Cal State.

Saving for college has become a priority for our family and I’m glad to have learned about ScholarShare. I know that the key to saving is through a 529 plan and ScholarShare has a fantastic program designed for parents just like you and me. The new ScholarShare plan significantly reduces fees, expands the investment lineup, and offers online and mobile tools to make California’s 529 plan more accessible and easier to manage. The minimum initial contribution to open an account is now only $25, down from $50 a year ago.Under the revamped plan, fees will be reduced by approximately 30 percent, making ScholarShare one of the lowest cost 529 plans in the country.

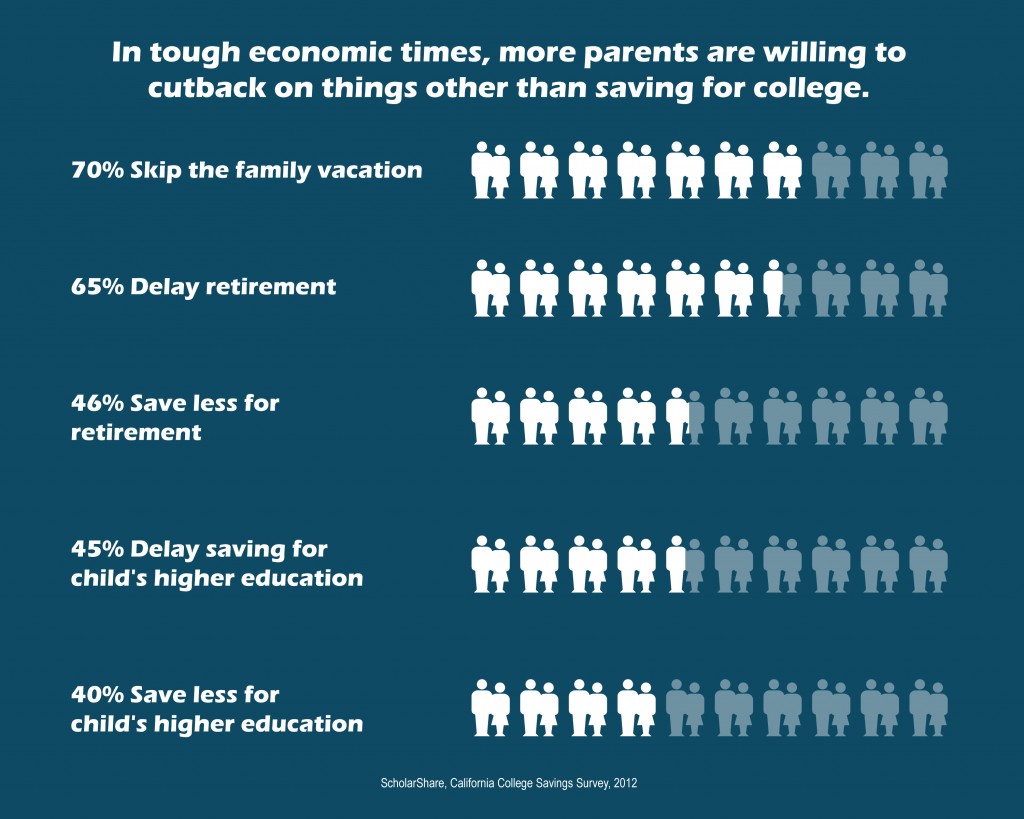

I know in this economic climate, saving for college might be at the bottom of the list for many people. However, when I see the numbers and think how only $25 is all that is needed, I start to think, I can do that. I can stop drinking some Starbucks or get a pedicure. Those things are trivial compared to my son and daughter, having to struggle with college loan debt. If you would like to learn more about ScholarShare and what you can do to start those college savings account, head over here. You can also follow ScholarShare on Facebook and Twitter. I know I’m not waiting any longer, especially after this evening’s email. I hope you don’t either.

Disclosure: This is a sponsored post from One2One Network and Scholarshare. However, All opinions stated are my own.